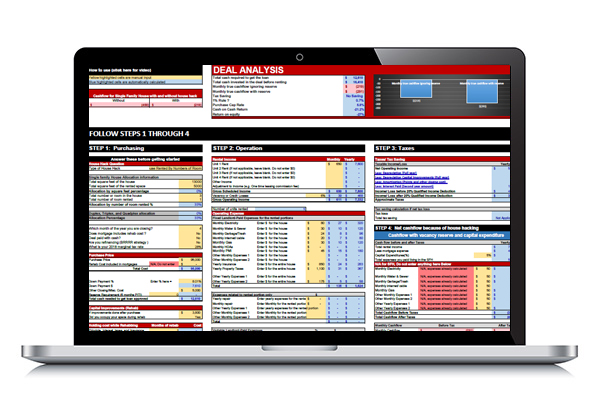

Normal Turn Key Rental Analyzer (Cash, Bank, Private Money, and Hard Money)

- Tab 1 - Rental financing analysis

- Calculates the cash required for an investment loan approval.

- Has options to use various financing: cash, bank financing, private money, and hard money lenders.

- Tab 2 - Rental Operational analysis

- Calculates before and after-tax flow and actual tax savings from the investment, if any

- Factors in actual depreciation calculated in the depreciation schedule (included)

- Factors in additional depreciation for capital improvements (rehab) (included)

- Factors in actual interest expense deduction from the loan amortization schedule (included)

- Tab 3 - Five-year forecast of the property

- Factors in both refinanced and non-refinanced scenarios in the forecas.t

- Shows five-year projections with the user input growth rate for rent, expense, and property valu.

- Shows gain and tax implications if sold within five years.

- Shows actual cash flow after paying off the remaining mortgage balance

- Tab 4 - Determine the depreciable basis of the property by categorizing expenses from the closing statement

- Categories cost from the closing statement to properly calculate depreciable basis

- Allocates purchase price to land and building

- Quantifies the impact of refinancing on old loan fees (points) and new loan fees (points)

- Determines the depreciable cost of rehab after deducting deductible repairs

- Incorporates personal expenses that are incurred to acquire the property

- Tab 5 - Depreciation schedule of the property (both residential and nonresidential)

- Tab 6 - Deprecation schedule of the capital improvements (both residential and nonresidential)

- Tab 7 - Loan Amortization Schedule